On the 23rd of July, the Indian Budget for 2024 was presented by Finance Minister, Nirmala Sitharaman, which focuses on sustainable growth, infrastructure development, and inclusive economic progress. Whilst this budget has been praised by many, there has been some criticism with the way the budget deals with the tax which has affected middle-income families the most.

Let’s first talk about the positives. One of the main benefits of this budget is that there is a clear emphasis on developing infrastructure. The budget allocates a historic ₹11.11 lakh crore (roughly £102.5 billion) for infrastructure development, representing 3.4% of the Indian GDP. This investment is aimed at enhancing urban housing, improving rural connectivity, and developing industrial corridors such as the Amritsar-Kolkata and Vizag-Chennai corridors. This is a much-needed investment especially given recent incidents within the country of the infrastructure failing.

Another benefit of the budget is that there is a clear emphasis on more renewable and more sustainable methods of growth. For example, the recent budget has given tax breaks to companies who are investing heavily in renewable energy sources, helping to encourage companies/large co-operations to move away from fossil fuels which have been polluting Indian cities for decades. Due to these policies, it is expected that by 2030, India is committed to be achieving 500 GW of renewable energy.

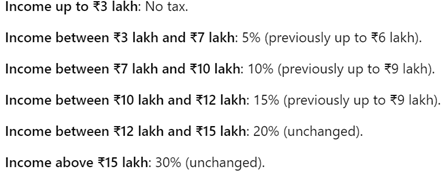

However, the main criticism of this budget has been the way the government has structured the taxes.

As seen from the above, taxes have been increased for people earning between 3 lakh rupees to 12 lakh rupees whereas those earning above 12 lakh rupees have not been affected at all. This has led to criticism of the government as it is widely perceived by both the general public and the opposition party that the Modi government is favouring the rich in order to gain their support. The most notable example of this is with Gautam Adani who has seen his personal net worth grow by 430% since Modi’s arrival in 2014 and in return and in return Adani has been giving political donations to the BJP government.

Whether the budget has been a success or not can only be seen in the long-term as Modi has vowed to overtake Germany to make India become the 3rd largest economy in the world. If he manages to do this by 2027, it will be a very historic moment in Indian history and would cement Modi as being one of the best prime ministers in Indian history.

Leave a Reply