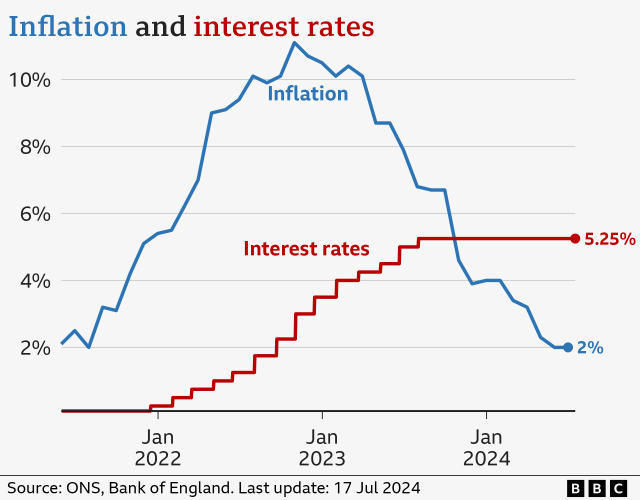

If you’ve been paying attention to financial news lately, you’ve probably heard a lot of talk about interest rates. As we move through 2024, interest rates have become a major focus for consumers, businesses, and policymakers alike.

To start, the key interest rate set by the Federal Reserve, known as the federal funds rate, currently stands at 5.25% as of July 2024. This is a significant increase from the near-zero level that was in place for most of 2020 and 2021. The Fed has been raising rates steadily since early 2022 in an effort to get high inflation under control.

These increases in the federal funds rate have had a ripple effect across the economy. For example, the average 30-year fixed mortgage rate is now around 6.5%, up from under 3% at the start of 2022. This has made it much more expensive for people to buy homes, leading to a slowdown in the housing market.

Rates on business loans and credit cards have also gone up sharply. The prime lending rate, which is a benchmark for many types of loans, is currently at 8.25%. And the average APR on new credit card offers is now over 20%.

On the plus side for savers, interest rates on bank deposits have finally started to improve after years of low returns. The average annual percentage yield (APY) on a one-year CD has reached around 3.5% – the highest level in over a decade. However, these higher deposit rates have still lagged behind the rapid inflation that consumers have been dealing with.

Looking ahead, the path of future interest rate changes remains uncertain. The Fed has indicated that more rate hikes may still be needed to fully control inflation. But the extent and pace of any future increases will depend on economic data in the months ahead.

Consumers and businesses will need to stay on top of these interest rate developments and adjust their financial strategies accordingly. Things like mortgage refinancing, business borrowing, and investment decisions will all be impacted.

Overall, the current interest rate environment represents a significant shift from the low-rate era of the recent past. It’s an important dynamic to understand, as it will continue to shape the financial landscape for individuals and the broader economy in the year ahead.

Leave a Reply