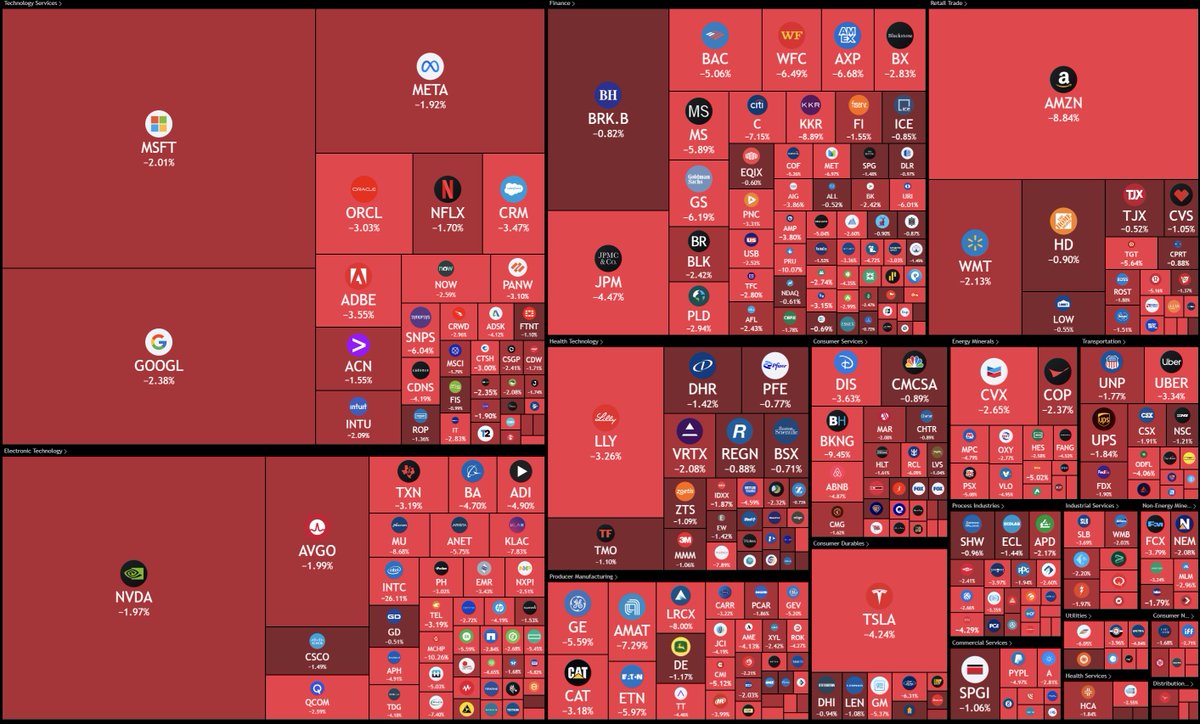

August 2, 2024 — On Friday, the financial markets globally witnessed a rapid drop as a result of several disappointing economic data from US, and feeble earnings report from major technology companies tied to mounting geopolitical tensions.

The initial cause of the market upheaval was a shocking employment report coming out of America. Job creation for July stood at only 114,000 jobs compared to the expected 175,000. Moreover, unemployment increased from 4.1% to 4.3%, showing that there is an abrupt slowdown in job growth rate. These numbers have heightened fears that the United States might be heading toward recession faster than expected.

As a result, some investors are beginning to think that the Federal Reserve may need a very big cut in interest rates to stimulate economic growth. The market is now pricing in a full 100% chance of a rate reduction at their September meeting with up to fifty basis points being cut after weak employment data.

Another sector greatly affected by this downward turn is the technology area – its cornerstone. In early trading on Tuesday, Nasdaq dropped by close to three percent bringing it closer to correction territory which is ten percent off its historical peak: Intel’s poor results emerged as critical factors behind this decline too.

International stock indices clearly showed that there was widespread global influence of the US market’s weakness. The Nikkei 225 index in Japan fell as low as last January when it dropped by 5.8% marking its worst day since COVID-19 outbreak. Additionally, the broader Topix index declined by 6.1%. In Europe, France’s CAC 40 reached a level not seen since November last year and Germany’s DAX declined by 2%.

Among European tech stocks, Dutch chipmaking equipment manufacturer ASML shares went down by 9.6% while ASM International, their competitor lost up to 13.7%. FTSE 100 of London fell over 120 points or a decline of 1.5%.

Instagram has been blocked in Turkey following the killing of a Hamas leader which is believed to be part of wider geopolitical tension that has aggravated the global sell-off driven also by economy and tech sector issues.

The sell-off followed a tough day for US markets on Thursday where the Dow Jones Industrial Average fell by nearly 500 points or about 1.2%, after data revealed that American manufacturing activity had dropped and new unemployment claims had increased again. New orders for goods made in America were down at -3.3%, adding concerns of weakening demand.

The confluence of weak economic indicators, disappointing tech earnings, and escalating geopolitical tensions—including the recent unrest in Turkey—has created a highly volatile environment for global markets. As investors navigate these uncertainties, the financial outlook remains precarious, with growing speculation about potential central bank actions to stabilize the economy.

Leave a Reply